Announcement

Grand Finale was held on 01.01.2024 at Bengaluru

| Winner | Team Key AI (Bhumika Rana & Tanu Tomar) |

| First Runner Up | Team Radiant Ranger (Ankan Bera) |

| Second Runner Up | Team MetaData (Ekshan Raj Verma) |

| Grand Finale Finalists (Consolation Prizes) |

| Team Reborn 2.0 (Shriram K V & Giridhararajan) |

| Team AIOverflow (A Chethan Reddy & Subhanu Sankar Roy) |

Shortlisted ideas for prototype phase are mentioned below:

| Name | Team Name | Theme | |

| varada vamsi | vamsi.varada669@gmail.com | vamsi.varada669_9fff |

Build an analytics-based technology solution stack for Customer Experience

|

| Ekshan Raj Verma | ch20btech11012@iith.ac.in | MetaData |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Shriram K V | shriramkv@gmail.com |

Reborn 2.0

|

Build an analytics-based technology solution stack for Customer Experience

|

| Giridhararajan | girimercury97@gmail.com | ||

| Ankan Bera | eklapothik54@gmail.com | Radiant Ranger |

Build an analytics-based technology solution stack for Customer Experience

|

| Priti Yadav | pritiyadav888@gmail.com |

pritiyadav888_7186

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Rudra Yadav | rudi23114@icloud.com | ||

| Rashmi Bisht | rashmi.bisht32@gmail.com | ||

| kishore kunal | kishore.1js17cs047@gmail.com | kishore.1js17cs047_599f |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Thalirnila | thalirnila2@gmail.com |

AI wizards

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Preetha | preethaabu04@gmail.com | ||

| sowmiya Ravanan | sowmiyaravanan3@gmail.com | ||

| Sowmiya lakshmi | sowmya.arun2383@gmail.com | ||

| S. Dharanya | dharanyasenthil12@gmail.com | ||

| Uday Mahajan | mahajanuday144@gmail.com |

BROgrammers

|

Build an analytics-based technology solution stack for Customer Experience

|

| Shantanu Sakpal | shantanuesakpal1420@gmail.com | ||

| Sonia D'Silva | sonia.dsilva.2003@gmail.com | ||

| Harsh Vikas Shetye | harsh.shetye2403@gmail.com | ||

| abhishek sinha | abhishekssinha2003@gmail.com | ||

| Deepan GK | deepan.gk@ajafirm.com | deepan.gk_e4b5 |

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Akshay A S | akshay.aa67@gmail.com |

Fintech-ids

|

Build an analytics-based technology solution stack for Customer Experience

|

| Chayan Datta | sonicxxx7@gmail.com | ||

| Amit Siddharth | siddharthamit2000@gmail.com |

Idea Creators

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Kaviarasan | kaviarasan@in22labs.com | ||

| Preetham V C | preetham@in22labs.com | ||

| sagarhk | sagarhk@canarabank.com | SAGAR HK |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Shruti Gupta | shrutigupta5555@gmail.com |

haxk

|

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Aakash Shrivastava | aakashferrari@gmail.com | ||

| Bhumika Rana | bhumu983@gmail.com |

Key AI

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Tanu Tomar | tomartanu647@gmail.com | ||

| G Aditya Kumar | aditya06112002@gmail.com |

404 Found

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Aditi katiyar | aditi.katiyar02@gmail.com | ||

| Ananya Redhu | ananya.redhu2020@vitstudent.ac.in | ||

| Prince Choudhary | pc16oct@gmail.com | ||

| Tisha Patel | patelt2526@gmail.com | ||

| ANANYA JALONHA | jalonha.ananya@gmail.com |

jalonha.ananya_0695

|

Build an analytics-based technology solution stack for Customer Experience

|

| Palak Gupta | 09palakgupta@gmail.com | ||

| Rudri Vasavada | rudri10.vasavada@gmail.com | ||

| Prabha Narayan | pn@qkrishi.com | pn18_d675 |

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Abhijeet Singh | vayuabhijeet@gmail.com |

CyberTrace

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Roshan Dnyaneshwar Padal | rdpadal@gmail.com | ||

| Yogesh Vishwanath Kute | yogeshkute777@gmail.com | ||

| Aditya Vasant Dalvi | adityadalvi631@gmail.com |

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

|

| Dhivakar Jacob S | dhivakarjacob.s@indianbank.co.in |

dhivakarjacob.s_e423

|

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Viswanath M | viswanath.m@indianbank.co.in | ||

| Prasanth.ps | prasanth.ps@holosuit.com | prasanth.ps_7ac1 |

Build an analytics-based technology solution stack for Customer Experience

|

| RINOSH JACOB KURIAN | rinosh.kurian@ultsglobal.com | rinosh.kurian_fe64 |

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Soumyashree Nayak | nayaksoumyashree2003@gmail.com |

Business Deal

|

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Anish Behuray | anishbehuray.work@gmail.com | ||

| Rakhul K R | cenentury0941@gmail.com | Precede Gesture |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Chandrachud Pati | chandrachudpati@gmail.com | Chandrachud23_fafe |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Sayash | sayashiitm@gmail.com | sayashiitm_a46e |

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Shrikrishna | krishnakailasa2000@gmail.com |

krishnakailasa2000_c822

|

Build an analytics-based technology solution stack for Fraud Prevention & Prescription

|

| Keerthana T V | keerthanataltaje@gmail.com | ||

| S | swasthikadevadiga2@gmail.com | ||

| Harshit Chaurasia | c.harshit2102@gmail.com |

InsightEdge

|

Build an analytics-based technology solution stack for Customer Experience

|

| Prateek Pal | prateekpal641@gmail.com | ||

| Anurag Mishra | anurag.fractal.iet@gmail.com | ||

| Aarushi Singh | aarushisingh2311@gmail.com | ||

| Maida Iftikhar Chikan | maidaiftikhar8@gmail.com | ||

| A Chethan Reddy | achethanreddy1921@gmail.com |

AIOverflow

|

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Subhanu Sankar Roy | subhanu12@gmail.com | ||

| Samanwith KSN | samanwith21@gmail.com |

GreyLife

|

Build an analytics-based technology solution stack for Default Prediction & Prevention

|

| Badri Akkala | lcb2021029@iiitl.ac.in |

Objective of the Hackathon

In line with our bank’s tagline ‘Together We Can’ and our mission to provide State-of-the-Art banking solutions, leveraging technology, aiding Ease of Doing business and enhancing value for all stakeholders through inclusive growth, we are actively implementing a series of strategic measures. One of these initiatives involves bringing together individuals with strong technical backgrounds to collaborate and leverage their skills for problem-solving and the generation of fresh, innovative ideas.

To put this initiative into action, Canara Bank is excited to announce Canara DACOE-Thon (Data Analytics Centre of Excellence) hackathon. Our primary goal is to cultivate high-impact, practical business concepts and innovative product ideas. This hackathon serves as a platform for individuals to work collectively, drawing from their technical expertise, to address real-world challenges and contribute to the advancement of the banking industry. Through this event, we aim to encourage creative thinking and to ultimately develop solutions that enhance the overall banking experience and provide substantial value to our customers and stakeholders.

We welcome you to be a part of this transformative journey.

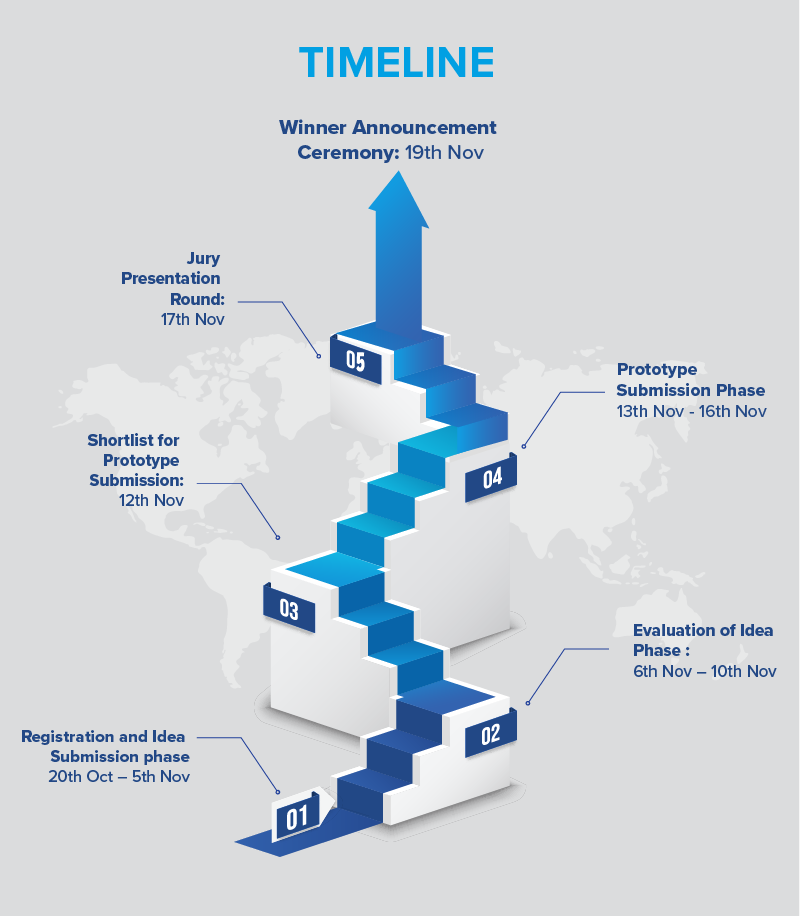

Timeline

About Canara Bank

Widely known for customer centricity, Canara Bank was founded by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906, at Mangalore, then a small port town in Karnataka. The Bank has gone through the various phases of its growth trajectory over hundred years of its existence. Growth of Canara Bank was phenomenal, especially after nationalization in the year 1969, attaining the status of a national level player in terms of geographical reach and clientele segments. Eighties was characterized by business diversification for the Bank. In June 2006, the Bank completed a century of operation in the Indian banking industry.